We can’t pretend to have a crystal ball and make any hard and fast predictions, but barring a significant recession (in January the worry was further interest hikes), the fundamentals make a strong case that the bottom is in and that London is poised to recover quickest nationwide. Here why we think this is the case:

Unprecedented price drop, faster and further than the rest:

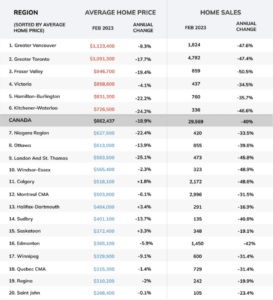

Even though prices are still at least 33-50% higher than pre-pandemic levels, the largest average home price drop in its history saw London and St. Thomas had a higher percentage decline in average home prices than all major Canadian cities. It also has a relatively lower number of home sales, with a decline of 45.8% compared to the previous year.

Based on the information provided in the table, London and St. Thomas have an average home price of $583,500 in February 2023, which is below the national average of $662,437. The region has also experienced a significant decrease in average home prices over the past year, with a 25.1% drop, which is higher than the national average of an 18.9% decline.

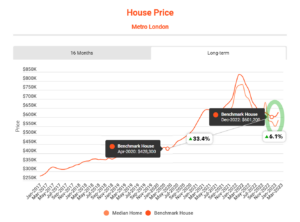

Prices have started to level and have turned in February

As predicted in our last Outlook, both the sales activity and average price drops had begun to soften and showed signs of turning, now that has been confirmed with the first average price increase of 6% month over month in February. Speaking for London and St. Thomas markets specifically, we are calling this range the bottom. With continued recession fears and high interest rates we don’t see a significant price pop until next year, but if you’re a buyer it doesn’t make sense to think that your killer deal is coming in the winter.

Market fundamentals are driving even more demand

The housing shortage hasn’t been touched as home sale volumes are still at historic lows, so demand is still at a historic high. As of last year, London is the fastest growing city in Ontario. With Canada’s population hitting a record growth last year, London’s has been predicted to grow at an unprecedented rate for the next 50 years.

London’s unsexy economy is now a national leader

The pandemic recovery saw the London region’s economy grow at a faster pace than all other southern Ontario cities, and downtown core recovery leads the nation. Without the exodus of tech jobs plaguing other cities, the diverse nature of the local economy will continue to weather 2023’s rough patch.

Affordability relative to the rest

Looking at where we’ve landed with current province-wide prices, London’s lower average home price puts it back in a competitive position, and has kept demand for new homes from falling further.

CMHC reports that once interest rates stabilize, home-buying demand should return, putting upward pressure on prices again this year. Renters boxed out of the ownership and those waiting on the sidelines for market conditions to stabilize, will be leaping in markets like London first, where there is far more value to be had compared to higher priced regions. It might be a good idea to start comparing home builders that are now pricing fairly in the current market, as any new developments coming online in the latter half of next year will be on the rise again in 2024.

Every homeowner’s finance and lifestyle is their own, but one thing is certain regardless of market conditions- working with a builder that will provide the most value for your investment at the time both in the lot and the build is key.